A strong wave of capital is sweeping Ethereum after Trump signed the Genius Act.

Within 24 hours after the bill was passed, Ethereum soared by 8%, breaking through $3,600, a new high this year, and its market value soared to $437.9 billion. “The biggest beneficiary of the Genius Act is Ethereum, because 90% of RWA and stablecoins are deployed on Ethereum,” said Andrew Keys, chairman of the company.

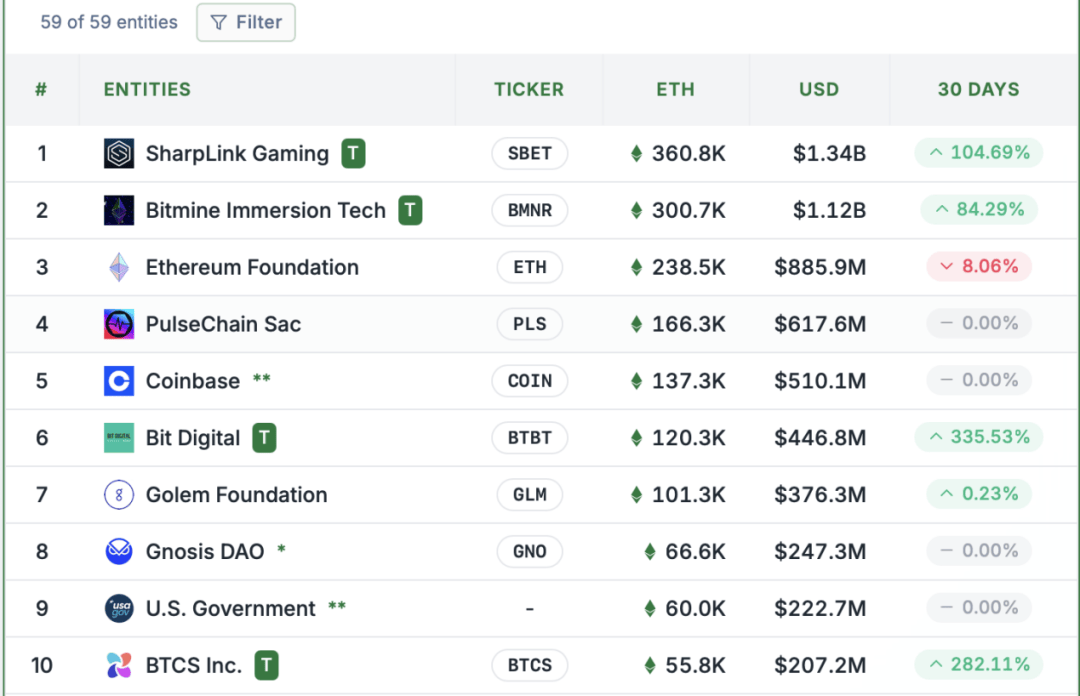

Many US listed companies also heard the news and intensively adjusted their cryptocurrency reserve strategies to include Ethereum in its core balance sheet. According to Strategic ETH Reserve data, the four listed companies recently added 113,300 new Ethereum positions. In addition, the number of entities holding Ethereum has increased from 40 in June to 59 on July 23.

Some investors said that Ethereum is shifting from “technical trials” to “institutional-level assets”, and the strategy of enterprises to convert Ethereum into an interest-generating tool through pledge and DeFi may reshape the logic of global corporate capital management.

Driven by regulatory certainty, US listed companies have set off an ” arms race ” for Ethereum. According to Strategic ETH Reserve, the number of entities holding Ethereum increased to 59 as of July 23, and the total holdings of the top 10 listed companies exceeded 860,000 Ethereum, with a total value of about US$3.2 billion, an increase of 45% from June.

SharpLink Gaming has become the largest holding agency with 360,000 Ethereum (about $1.3 billion), surpassing the Ethereum Foundation, and its executive board members include Ethereum co-founder Joseph Lubin.

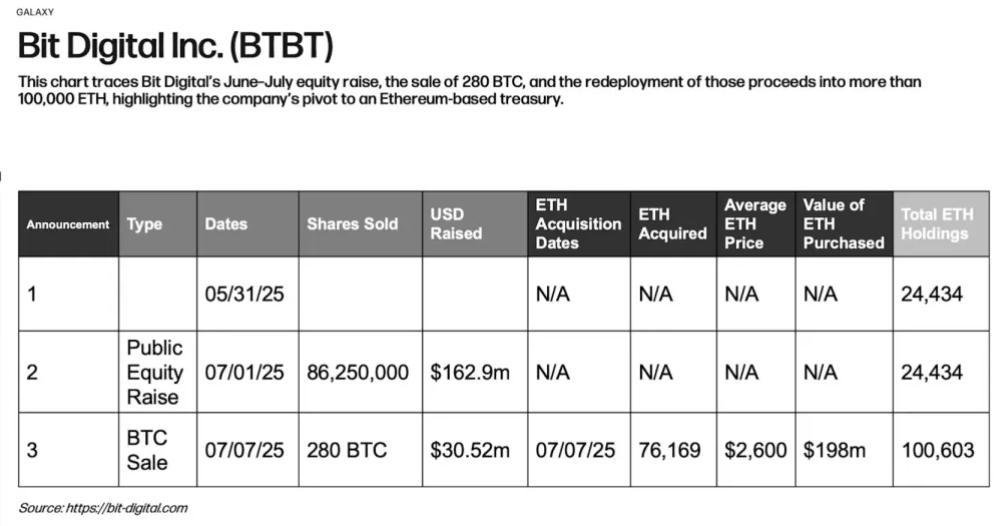

There is also a company’s capital reserve strategy that has attracted high market attention. Bit Digital, a New York-based digital asset platform, started operating in 2015 and initially operated large-scale Bitcoin mining sites in the United States, Canada and Iceland.

In June this year, the company completed a public issuance, raising about US$172 million, and at the same time cleared Bitcoin assets and purchased 120,000 Ethereum . Bit Digital’s CEO made it clear that the increase in Ethereum is due to its potential to “reshape the financial system.”