US President Trump announced on his social media “Real Social” that from October 1, the United States will implement a new round of high tariffs on multiple categories of imported products. Measures include:

- A 50% tariff is imposed on kitchen cabinets, bathroom sinks and related building materials

- 30% tariff is imposed on imported furniture

- 100% tariffs are imposed on patents and branded drugs

Trump also announced on the same day that he would impose a 25% tariff on all imported heavy trucks starting from October 1.

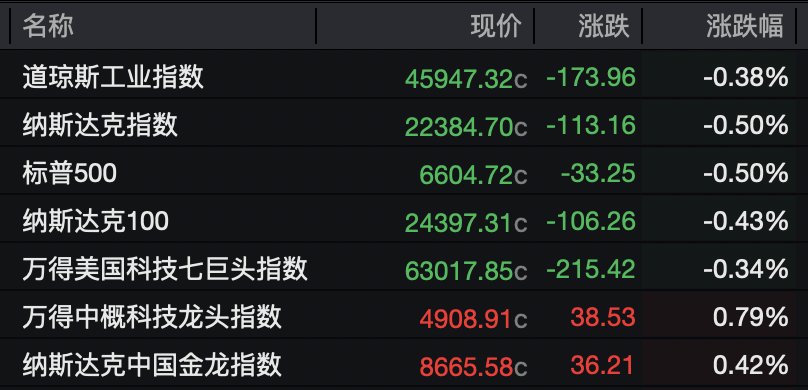

Last night, the three major U.S. stock indexes closed down collectively, with the Dow Jones Industrial Average falling 0.38%, the Nasdaq fell 0.5%, and the S&P 500 fell 0.5%. Most of the large technology stocks fell, Oracle fell by more than 5%, while Meta, Amazon, Microsoft and Google fell. Intel rose by more than 8% against the trend, Apple rose by more than 1.8%, and Nvidia and Netflix rose slightly.

Most popular Chinese stocks rose, while the Nasdaq China Golden Dragon Index closed up 0.42%. Kingsoft Cloud rose by more than 6%, NIO, Xpeng Motors and Bilibili rose by more than 4%, and Baidu and Ideal Auto rose by more than 1%.

The latest speech by Fed officials has sparked speculation from global investors: on the one hand, some continue to cool down sharp interest rate cuts, and on the other hand, some believe that interest rate cuts should continue and send new signals of reform to the market.

Fed Gulsby said that Fed policy has maintained a moderate tightening and no secondary impact on prices has been seen. Keeping interest rates stable while inflation rises is equivalent to cutting interest rates, and the new GDP data does not change its perception of growth trends. Fed Daly said interest rates remain moderately tightened and further rate cuts may be needed over time . It is worth noting that Fed Logan said that “the Fed has reached the time and needs to modernize the interest rate target system.” He believes that it is time to prepare for the new benchmark interest rate .

Trump once again “blame” Fed Chairman Powell. He said our interest rates were too high, and if it weren’t for Powell, the Fed’s current interest rate level might be only 2%.

According to CME’s “Federal Observation”: the probability of the Fed cutting interest rates by 25 basis points in October is 85.5%. The probability of the Fed’s cumulative interest rate cut of 25 basis points in December is 35.4%, and the probability of the cumulative interest rate cut of 50 basis points is 60.4%.

After the news was released, silver shocked. On September 25, London spot silver closed up 2.83%, breaking through the $45 mark strongly. At the opening of September 26, London spot silver fell sharply, and the decline expanded to 1.02% as of press time.