Gold broke through the $3,000 mark, which is the first quarter of this year. It broke through the $3,500 in May, and then fluctuated for a while. Recently, it suddenly exploded again and broke through the $3,800 mark at one point.

In September this year alone, the cumulative increase in spot gold has exceeded 6%. In 2025 alone, the price of gold has hit a record high of nominal prices for more than 30 times.

All walks of life can’t help but sigh– Is gold crazy? What is the mysterious driving force behind it?

Continuous interest rate cuts are expected to boost gold prices

In terms of short-term factors, the rise in gold is directly related to the Fed’s interest rate cut.

At 2 a.m. Beijing time on September 18, the Federal Reserve decided to lower the target range of the federal funds rate by 25 basis points ( BP ) to between 4.00% and 4.25% , which is the first rate cut since September 2024, and the Federal Reserve expects to cut interest rates twice this year.

This dovish statement directly pushed gold to soar , with spot gold rising to a maximum of $3,700 per ounce, breaking the historical peak of inflation adjustment in 1980.

Generally speaking, both Treasury bonds and gold are considered safe-haven assets, but when interest rate cuts lead to lower yields in Treasury bonds , gold’s attractiveness as an alternative is enhanced. Since gold itself does not generate interest or dividends, the attractiveness of gold will increase when other assets that provide income lose their appeal.

In addition to the interest rate cut itself, the US employment data has “exploded” for two consecutive months, and the market has begun to worry about the US economy. At the same time, Trump continues to put political pressure on the Fed, which also makes the market worried that the Fed’s independence will be threatened.

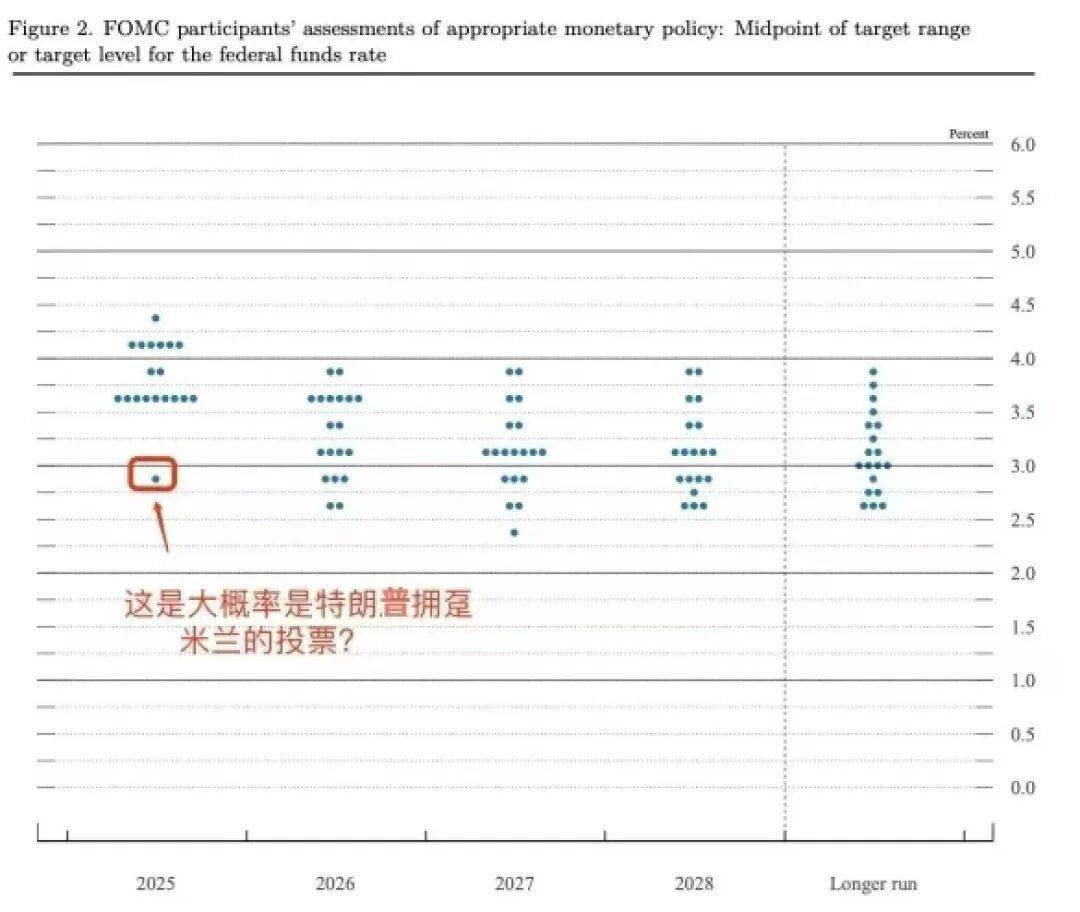

Although each Fed rate decision needs to be decided by 12 voting committee members, the president’s influence may be subtle. For example, 11 people supported a rate cut of 25BP in this resolution, and the only opponent was Stephen Miran, the Federal Reserve Director who was just confirmed by the Senate to join the board of directors that week . This Trump supporter is not against a rate cut , but advocates a one-time rate cut of 50BP.

From the “dot map” released by FOMC, we can find that the first column shows the voting committee’s forecast of interest rate levels this year, which is generally expected to be around 3.7%, and one of the larger deviations fell near 2.9%, which undoubtedly added dovish color to the Federal Reserve.

It can be seen that all this is driving gold higher. In September, UBS said it had raised its gold target price to $3,800 at the end of this year and $3,900 in June next year. In addition to the interest rate cuts, geopolitical uncertainty and the continued strong investment demand are also beneficial to gold prices.